Christina Argyrou, Manager

Financial Accounting and Advisory Services

EY Cyprus

Are you tired of scrolling and reading throughout long and multiple pages filled with every single detail of each accounting policy your entity of interest is using the last couple of years, only to find what really matters for you in page 25? Don’t get me wrong! I do that for living.

But it wasn’t long ago, that the International Accounting Standards Board (IASB or the Board) discussed this matter. After all, this is an attempt to simply enhance communication in financial reporting. Investors have told the IASB that it can be difficult and time-consuming for them to find useful information because IFRS financial statements are often poorly presented[2]. To achieve this effectiveness of financial information for main users, the ''Disclosure Initiative'' project was established. The Board launched the ''Better Communication in Financial Reporting'' initiative several years ago, highlighting the importance and common themes of a number of projects. One of those projects is the amendments to IAS 1 Presentation of Financial Statements and to IFRS Practice Statement 2 Making materiality Judgments (the PS) [3].

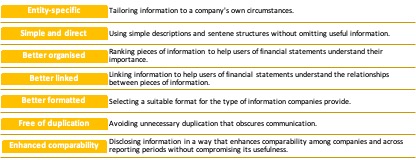

The overall idea, that the amended standard reinforces, is that entity-specific information is generally more useful to users than standardised information which simply repeats what the applicable IFRS accounting standard requires. The following table identifies the principles of effective communication that the Board introduced in its paper “Better Communication in Financial Reporting - Making disclosures more meaningful”.

Better Communication in Financial Reporting – Making disclosures more meaningful (here)

Specifically, the amendments aim to help entities provide accounting policy disclosures that are more useful to their intended users (being, existing and potential investors, lenders and other creditors). Feedback on the IASB’s March 2017 Discussion Paper Disclosure Initiative – Principles of Disclosure [4] suggested that further guidance, with materiality as a basis, should be developed to help entities provide more effective accounting policy disclosures since some entities find it difficult to assess whether an accounting policy is ''significant''. This calls for replacing the requirement for entities to disclose their ''significant'' accounting policies with a requirement to disclose their “material” accounting policies. Of course, this change and its application won’t be an easy task for the preparers and by extension for the auditors. But before we all start feeling hopeless, note that the Board also added guidance and illustrative examples on how entities apply the concept of materiality in making decisions about accounting policy disclosures.

Let’s kick it off with the key concepts. Materiality lies at the heart of Corporate Reporting[5].

Materiality

''Material'' [6] is a defined term in IFRS and is widely understood by the users of financial statements, compared to the term ''significant'' for which no definition was ever written.

As per the amendments and the concept of materiality, an accounting policy information is material if, when considered together with other information included in the financial statements, it can reasonably be expected to influence decisions that the primary users make. Accounting policy information would rarely be assessed as material when considered in isolation since accounting policy information on its own is unlikely to influence decisions that the primary users make based on the financial statements.

In this assessment, entities need to consider both the size of the transactions, other events or conditions and the nature of them. This assessment involves judgement and requires consideration of both qualitative and quantitative factors and could result in additional discussion and consideration by management.

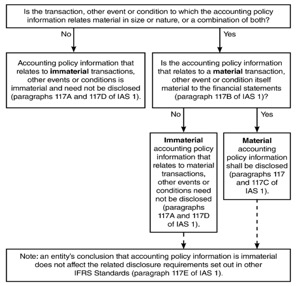

Diagram 2 of the PS, presented below, illustrates how entities should incorporate the different factors in the assessment of the materiality and apply judgment.

Diagram 2—determining whether accounting policy information is material (here)

Although a transaction, other event or condition to which the accounting policy information may be material, it does not necessarily mean that the corresponding accounting policy information is material to the entity’s financial statements. On the other hand, the amended IAS 1 highlights that, other disclosures required by IFRS may be material despite the corresponding accounting policy information being immaterial. The amendments do not relieve an entity from other disclosure requirements within IFRS literature. For example, if an entity determined that accounting policy information for income taxes is immaterial to the financial statements, other disclosures required by IAS 12 Income taxes may be material.

In addition, it’s important to note that the amended standard implicitly acknowledges that is not prohibitive disclosing immaterial accounting policies, although it is not required. If the entity decides so, it needs to ensure that this immaterial information does not obscure material information. The Board noted that standardised information could be, sometimes, material in specific circumstances.

The Shift

As previously mentioned, the general idea and aim by the Board with the latest amendments is the shift to a more entity-specific information in the financial statements rather than standardised information. For some this will “shake” their financial reporting. It’s admittable that is more valuable and useful to provide information that reflects an entity’s own specific circumstances, rather than repeating what the thousands of pages of IFRS literature. Primary users are considered to have a reasonable knowledge of business and economic activities and to review and analyse the information included in the financial statements diligently, therefore the material and entity specific information is more relevant and therefore more influential, even if they are lesser than what it used to be before the amendments. As the Former President of the European Commission said, Mr. Jean-Clause Juncker, ''sought to be big on big issues and small on the small ones''.

Tailoring accounting policy information is particularly relevant when judgement is applied. With the amended PS, the Board provides two examples to illustrate this difference between making materiality judgments by focusing on entity-specific information, while avoiding standardised (boilerplate) accounting policy information and providing accounting policy information that only duplicates requirements in IFRS.

The Challenge

Not only the preparers of the Financial Statements, who will be the first to face the challenges of these amendments, but of course our profession. The avalanche of the new requirements, and thus of new ways of thinking will very soon by on our doorstep.

Allow me to clarify that these amendments apply to full financial statements but not condensed interim financial statements and are becoming effective on or after 1 January 2023.

First things first, grasp the relevant requirements of the amendments and start revisiting accounting policy information disclosures in light of these amendments. Entities can enhance the usefulness of their financial statements by making accounting policy information disclosure more entity-specific and reducing the disclosure of immaterial and standardised accounting policies. This exercise can start early and in cooperation with the different parties involved in the financial reporting process.

The EY publication[7], ''Applying IFRS: Disclosure of accounting policy information'', provides relevant guidance, including more practical examples. We are always a phone call away to support you, plus our tool, EY Atlas Client Edition (here) is available for free to everyone and offers access to EY interpretations and thought leadership content.

[1] President Juncker announced the creation of the Task Force in his State of the Union address, on 13 September, saying: ''This Commission has sought to be big on big issues and small on the small ones and has done so. To finish the work we started, I am setting up a Subsidiarity and Proportionality Task Force to take a very critical look at all policy areas to make sure we are only acting where the EU adds value.'' Source: Future of Europe: President Juncker creates Task Force on 'doing less more efficiently' (europa.eu)

[2]Source: Better Communication—making disclosures more meaningful (ifrs.org)

[3] IASB press release for issuance of narrow-scope amendments to IFRS Standards at IFRS - IASB amends IFRS Standards to improve accounting policy disclosures and clarify distinction between accounting policies and accounting estimates.

[4] Discussion Paper – Principles of Disclosures (DP/2017/1) at Discussion Paper: Disclosure Initiative—Principles of Disclosure (ifrs.org) and the respective Comment letters are publicly available at IFRS - Discussion Paper and comment letters—Disclosure Initiative—Principles of Disclosure.

[5] Corporate Reporting, which encompasses financial and non-financial information, has become an important area of development for various organizations.

[6] As per IAS 1.7 ''Information is material if omitting, misstating or obscuring it could reasonably be expected to influence the decisions that the primary users of general-purpose financial reports make on the basis of those financial statements, which provide financial information about a specific reporting entity.''

[7] The publication ''Applying IFRS: Disclosure of accounting policy information'', in English, is accessible at Applying IFRS: Disclosure of accounting policy information | EY - Global.