By Pantelis Pavlou – Director and a member of the Central, Eastern and South-eastern Europe & Central Asia (CESA) IFRS team at EY [1]

As the title attests, this short article aims at busting the myth which states that IFRS 17 – Insurance Contracts is only relevant for insurers or for companies regulated as insurance entities.

Though it is true, IFRS 17 will predominately impact the insurance industry, all entities (even non-financial corporates) should carefully assess whether the new standard applies for their transactions and events. As a reminder, IFRS standards are not industry specific, but they address particular transactions and events, in this case: accounting for insurance contracts.

High level summary of IFRS 17

Before elaborating further in its scope allow me to set the scene for the new standard. IFRS 17 is the newest addition to the International Accounting Standards Board’s (IASB’s) standards, and it replaces IFRS 4, which has been labelled a temporary standard. IFRS 4 allows the grandfathering of previous practices and as such contributed to divergence in accounting for insurance contracts. Therefore, IFRS 17, being the first truly international accounting standard for insurance contracts, introduces quite some changes and challenges upon the transition to the new requirements.

In a nutshell, for the first time, accruals accounting will be implemented for insurance contracts. The statement of financial position will reflect the risk adjusted present value of future cash flows, including the unearned profit of the group of contracts (also called as contractual service margin or CSM), which is then released in the profit or loss over the coverage period. This means, that the profit or loss and statement of financial position for companies issuing insurance contracts would better reflect the economics of these contracts which in its turn would limit the need for alternative performance measures to explain the financial position, financial performance, and cash flows for insurance contracts. Last but not least, IFRS 17 will enhance the comparability across different entities and countries.

The myth

IFRS 17 is only relevant for insurers and companies regulated as insurance entities.

Busting it: IFRS 17 is not an industry standard, it applies to all insurance contracts. But to better understand this statement, we need to look at the scope, scope exceptions and key definitions of the standard.

Scope and scope exceptions

The scope of the standard refers, indeed, to insurance contracts. These are defined as contracts under which one party (the issuer) accepts a significant insurance risk (= non-financial risk) from another party (the policyholder) by agreeing to compensate the policyholder if a specific uncertain future event adversely affects the policyholder[2].

‘Risks’ exist for all entities and come in different forms. Financial risks may impact an entity through changes in market prices, including changes in interest rates, foreign exchange rates, credit ratings, equity prices or commodity prices. Whereas non-financial risks are other risks not driven from financial risks and are specific to a party to the arrangement.

Examples of non-financial risks include obsolescence or damage to inventory, death of an individual, motor vehicle accidents causing property damage or loss of life, and failure of a good or service to be fit for purpose. To mitigate non-financial risk, for example, the risk of a storm causing damage to a manufacturing plant, a manufacturer may consider diversifying its manufacturing locations, entering into a joint ownership arrangement, or entering into a contractual arrangement that compensates for any storm damages that may occur.

The following are some examples of arrangements that are designed to address the impact of non-financial risks (mitigate for a customer; create risk for the provider of protection):

- Life and general insurance policies,

- Warranty arrangements,

- Residual value guarantee contracts,

- Rent guarantees,

- Financial guarantee contracts,

- Performance bonds,

- Contingent consideration agreed in a business combination.

In line with the definition above, non-financial risk becomes insurance risk when one party accepts this risk from a counterparty. For example, when a manufacturer provides warranties for goods it sells to customers, it is effectively accepting the insurance risk that the product may be defective by promising to compensate or make good with the customer.

Under this broad definition, quite some contracts would need to be accounted in accordance with IFRS 17, even though other standards could apply for such transactions. To this end, the standard includes a list of arrangements that are excluded from its scope[3]. Analysing the scope of the standard is, thus, a very important step. In particular the standard excludes:

- Insurance contract as policyholder unless it is a reinsurance contract,

- Warranties issued directly by the manufacturer, dealer, or retailer in connection with the sale of the underlying item,

- Employers’ assets and liabilities from employee benefit plans,

- Contractual rights or obligations contingent on future use of, or the right to use a non-financial item (for example, future lease payments made only when COVID-19 restrictions are lifted),

- Residual value guarantees provided by the manufacturer, dealer, or retailer of goods it sells, and those provided by a lessee when embedded in the lease,

- Financial guarantee contracts (unless the issuer asserted it’s an insurance contract and accounts for it as insurance),

- Contingent consideration payable or receivable on business combinations,

- Certain credit card contracts that provide insurance coverage without assessing the insurance risk of the individual involved.

The theory to practice

Making this more tangible, the following practical examples help in explaining the points above.

Practical example 1

Company ABC Ltd sells monitors to customers offering a 4-year extended warranty for its product.

In this example, it is clear that the scope exception of IFRS 17 applies, as the warranty issued directly by the retailer in connection with the sale of products. This means that ABC Ltd will not apply IFRS 17 to account for the warranty, but instead it will fall under the scope of IFRS 15 – Revenue from contract with customers.

Practical example 2

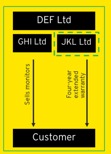

Group DEF has two fully owned subsidiaries: GHI Ltd which sell monitors to customers and JKL Ltd that provides a four-year warranty to customers of GHI Ltd.

For the consolidated financial statements, the reporting entity is DEF Group, and the fact pattern and conclusion are similar to the one in example 1 (above).

However, different considerations apply for the separate financial statements, where JKL Ltd issues a warranty for products for which it is not the manufacturer, dealer, or retailer. In this case the scope exception does not apply and JKL Ltd should consider whether the terms and conditions of the warranty contract would meet the definition of an insurance contract. If so, then it shall apply the requirements of IFRS 17.

Practical example 3

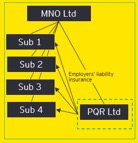

Group MNO has a number of fully owned subsidiaries. According to the local law, employers shall provide workers’ insurance (employer liability insurance). Given the size of the group and its workforce the group established an insurance entity, PQR Ltd, which provides the insurance contracts for all its sister companies. PQR Ltd does not have any contracts with external parties.

In this fact pattern there is no enforceable insurance contract with external parties, MNO group will ignore the self-insurance arrangement, and account for any liability related to worker’s compensation as an employee provision under IAS 19.

The analysis is different for the separate financial statements of PQR Ltd, which, in its perspective issues contracts that fall in scope of IFRS 17.

Concluding

The above examples show that IFRS 17 could also be relevant for entities other than those regulated as insurance companies. I reiterate, similarly to other standards in the literature, IFRS 17 applies for transactions and event and not to a specific industry.

A good understanding of the main requirements, and in particular the principles around its scope and definition is the starting point for a thorough analysis on whether an entity needs to apply this new standard.

As a reminder, IFRS 17 applies for annual periods starting on 1.1.2023 and upon transition, prior year comparatives must be restated, such that the transition date is the beginning of annual periods commencing on or after 1.1.2022. In addition, entities are reminded of the requirements of IAS 8 with regards to include sufficient information about the anticipated impact from the new standard in the financial statements for 2022 (interim and annual)[4].

Accounting for insurance contracts is, indeed, a complex topic. At EY, we are committed to maintaining a leading-edge understanding of the changes that may affect the business environment. Our tool, EY Atlas Client Edition[5] (here) is available for free to everyone and offers access to EY interpretations and thought leadership content.

Connect with the author via LI: www.linkedin.com/in/ppantelis

[1] The views expressed in this article represent the personal opinions of the author and not necessarily the official position of EY

[2] IFRS 17.Appendix A

[3] IFRS17.7

[4] esma32-339-208_esma_public_statement_on_implementation_of_ifrs_17.pdf (europa.eu)