Source: The New York Times

by Eshe Nelson

It is the most basic of staple food items: sliced white bread. In Britain, the average price of a loaf was 28 percent higher in April, at 1.39 pounds, or $1.72, than it was a year earlier.

In Italy, the price of spaghetti and other pasta, a fixture of the Italian diet, has risen nearly 17 percent from the year before. In Germany, the European Union’s largest economy, cheese prices are nearly 40 percent higher than a year ago, and potatoes cost 14 percent more.

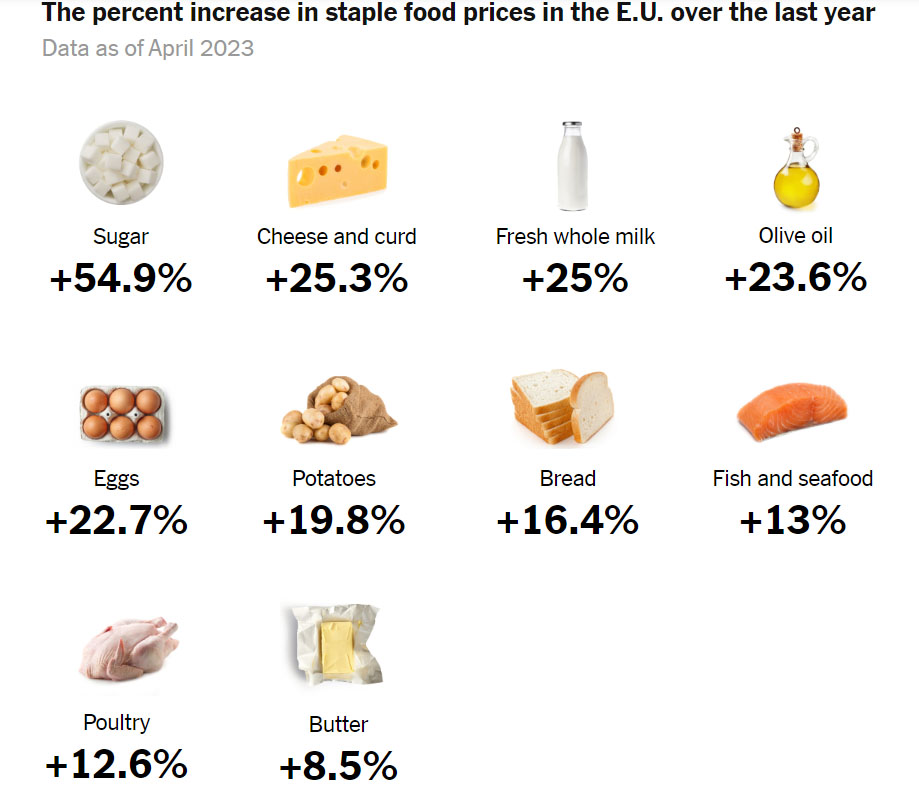

Throughout the European Union, consumer food prices were on average nearly 17 percent higher in April than a year earlier, a slight slowdown from the previous month, which set the fastest pace of growth in over two and a half decades. The situation is worse in Britain than in its Western European neighbors: Food and nonalcoholic drink prices were 19 percent higher, the quickest pace of annual food inflation in more than 45 years. By comparison, the annual rate of U.S. food inflation was 7.7 percent.

Source: Eurostat By Rebecca Lieberman

Source: Eurostat By Rebecca Lieberman

Persistent food inflation is squeezing low-income households and troubling European politicians. (In Italy, the government held a meeting this month to discuss soaring pasta prices.)

At the same time, the major costs that go into making food products, including fuel, wheat and other agricultural commodities, have been falling in international markets for much of the past year — raising questions about why food prices for consumers remain so high in Europe. And with rising labor costs and the possibility of profiteering, food prices are unlikely to come down anytime soon. More broadly, rising prices could also put pressure on central banks to keep interest rates high, potentially restraining economic growth.

What is driving up food prices?

Behind the sticker price for a loaf of bread includes the costs for not only key ingredients but also processing, packaging, transport, wages, storage and company markups.

A United Nations index of global food commodity prices, such as wheat, meat and vegetable oil, peaked in March 2022, immediately after Russia’s invasion of Ukraine, which is one of the largest grain producers. The war disrupted grain and oil production in the region and had a global impact, too, worsening food crises in parts of East Africa and the Middle East.

But the worst was avoided, in part because of a deal to export grain from Ukraine. European wheat prices have declined about 40 percent since last May. Global vegetable oil prices are down about 50 percent. But there is still a ways to go: The United Nations’ food price index was 34 percent higher in April than its 2019 average.

Aside from commodity prices, Europe has experienced particularly harsh increases in costs along the food supply chain.

Energy prices soared because the war forced Europe to rapidly replace Russian gas with new supplies, pushing up the costs of food production, transport and storage.

Though wholesale energy prices have fallen back down recently, retailers warn there’s a long lag — perhaps up to a year — before consumers will see the benefits of that because energy contracts were made months before, most likely reflecting those higher prices.

And the tight labor markets in Europe with high job vacancy rates and low levels of unemployment are forcing employers, including food companies, to push up wages to attract workers. This in turn drives up costs for businesses, including in the food sector.

Is profiteering keeping prices high?

Suspicions are growing among consumers, trade unions and some economists that inflation could be kept needlessly high by companies raising prices above their costs to protect profit margins. The European Central Bank said that at the end of last year, corporate profits were contributing to domestic inflation as much as wage growth, but it did not say if any industries had made excessive profits.

Economists at Allianz, the German insurer and asset manager, estimate that 10 to 20 percent of food inflation in Europe can be attributed to profiteering. “There is part of the food price inflation that we see which is not explainable, easily,” said Ludovic Subran, the chief economist at Allianz.

But the lack of detailed data about corporate profits and supply chains has caused a rift in economic opinions.

Some economists and food retailers have pointed fingers at big global food producers, which have sustained double-digit profit margins while raising prices. In April, the Swiss giant Nestlé said it expected its profit margin this year to be about the same as it was last year, about 17 percent, while it reported raising prices by almost 10 percent in the first quarter.

Even taking into account expenses like transport and accounting for pricing lags from farms to shelves, Mr. Subran said he would have expected food inflation to come down by now.

In Britain, some economists are telling a different story. Michael Saunders, an economist at Oxford Economics and former rate-setter at the Bank of England, said in a note to clients in May that “greedflation” was not the culprit. Most of the increase in inflation reflects the higher cost of energy and other commodities, he said.

Rather than rising, total profits for nonfinancial companies in Britain, excluding the oil and gas industry, have fallen over the past year, he said.

Britain’s competition regulator also said that it hadn’t seen evidence of competition concerns in the grocery sector, but that it was stepping up its investigation into “cost of living pressures.”

Have food prices peaked?

Despite well-publicized cuts to milk prices in Britain, food prices, in general, are unlikely to go down in the near future.

Instead, policymakers are closely watching for a slowdown in the rate of increases.

There are tentative signs that the pace of food inflation — the double-digit increase in annual prices — has reached its pinnacle. In April, the rate fell in the European Union for the first time in two years.

But the slowdown from here is likely to be gradual.

“It appears to be taking longer for food price pressures to work their way through the system this time than we had expected,” Andrew Bailey, the governor of the Bank of England, said this month.

Across the continent, some governments are intervening by capping prices on food essentials, rather than waiting for the economic debates about corporate profiteering to play out. In France, the government is pushing an “anti-inflation quarter,” asking food retailers to cut prices on some products until June. But the finance minister, Bruno Le Maire, said this month that he wanted food producers to contribute more to the effort, warning they could face tax penalties to recover any margins unfairly made at the expense of consumers if they refuse to return to negotiations.

These efforts may help some shoppers, but on the whole, there is little to comfort Europeans. Food prices are unlikely to decline — it’s likely only that the pace of increases will slow later this year.