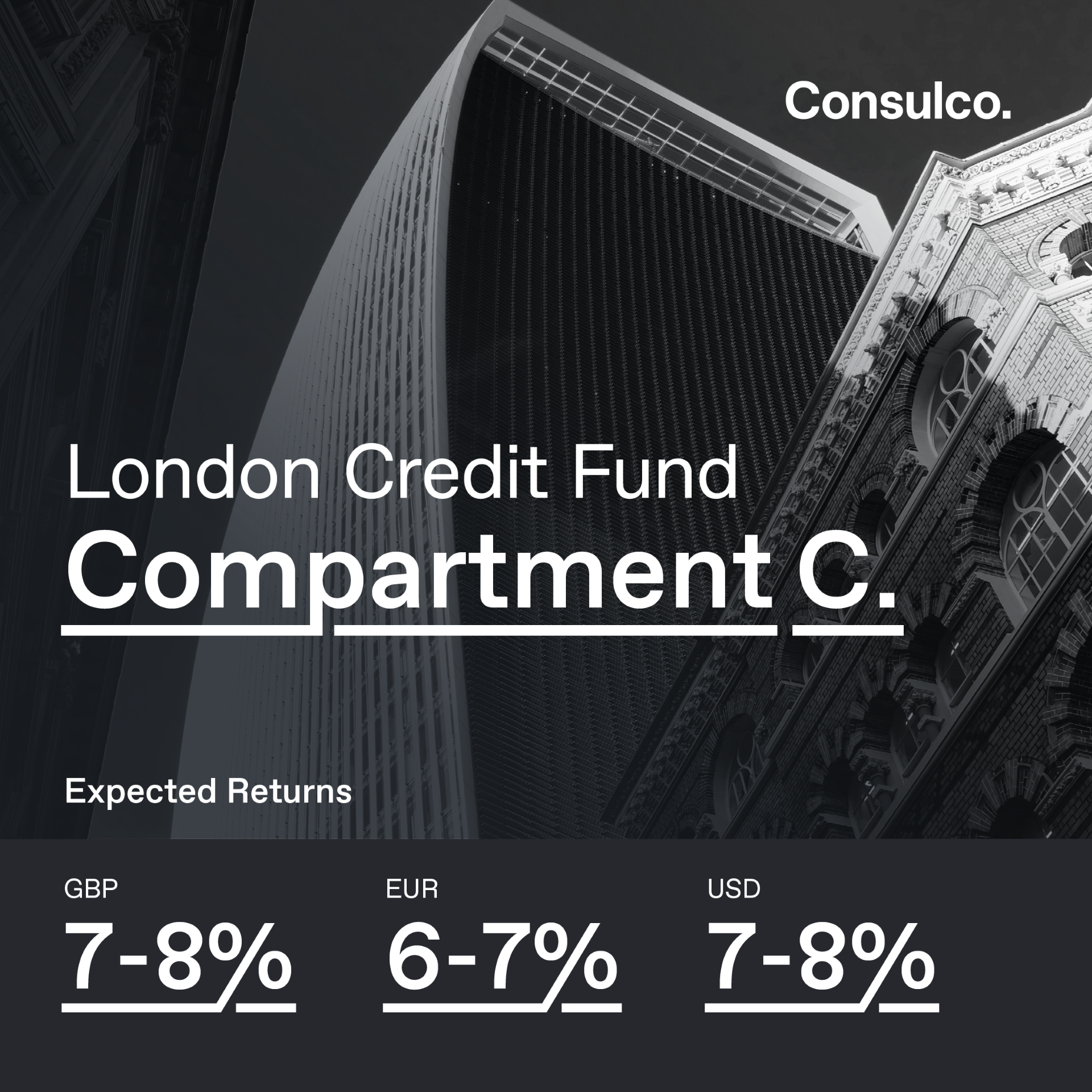

Consulco is delighted to announce the launch of Investment Compartment C, the newest sub-fund of the London Credit Fund. The new Compartment focuses on short-term lending predominantly for residential refurbishment and development financing projects in high-growth areas.

This structured approach targets competitive returns while reducing risk through rigorous asset-backed lending strategies.

This structured approach targets competitive returns while reducing risk through rigorous asset-backed lending strategies.

Investment Highlights:

- Target returns of 6%-7% p.a. for Euro investments and 7%-8% p.a. for Sterling & Dollar investments

- Underlying investments backed by UK real estate, one of the world’s most transparent, mature, and in-demand asset classes

- Minimum investment amount is €125,000, minimum lock-up period of 18 months and expected annual dividend payments.

What sets Compartment C apart is its focus on short-term development financing; a sector that consistently offers higher-yield potential with carefully managed exposure. By investing at the early stages of development projects and applying stringent lending criteria, the London Credit Fund optimises risk-adjusted returns while maintaining strong downside protection.

Since inception, the London Credit Fund has consistently exceeded its target returns, delivering strong performance even in fluctuating market conditions. Compartment C is designed to build on this success, offering investors a compelling mix of security, liquidity, and high returns.

A key factor behind this success is the strength of the London real estate market, which remains one of the most resilient property markets globally, with high demand for residential development driving up property values.

Today, the strength of the UK market is also reflected in Savills' latest residential updates from February 2025:

- Overall activity in the housing market is higher than 12 months ago, with January 2025 seeing a 13% increase compared to the same time last year.

- Prime markets (£1m+) are performing better than expected with activity 10% higher than last year, despite the impact of a higher tax environment.

- Interest rates – On February 6th 2025, the Bank of England reduced the base rate by 25bps to 4.50%, further supporting investment conditions.

The UK real estate market has long been a magnet for investors seeking stability and strong returns. With interest rates decreasing and demand for housing increasing, savvy investors are now turning to alternative investments, which are asset-backed for higher returns and lower risk.

The strong market performance underscores why now is an ideal time to explore investment opportunities. One such option is the London Credit Fund; here are a few key reasons why to invest with Consulco today:

- Proven Expertise – Consulco has over 13 years of experience in bridging lending with an impeccable loan collection rate.

- Multi-Currency Flexibility – Invest in Euros, Sterling, or Dollars, allowing for tailored portfolio diversification.

- Low Market Volatility – Investment strategies are backed by tangible real estate assets.

[LC London Credit AIF V.C.I.C. Public Ltd (“London Credit Fund”) - Licence Number: AIF50/2018]

Disclaimer: Please refer to the LC London Credit AIF V.C.I.C. Public Ltd (“the Fund”) prospectus before making any investment decision and consult your advisors. There are various risks to consider, including currency fluctuations, which may affect returns. Past performance is not indicative of future returns. The Fund is available only to Professional and Well-Informed investors.