Press Release

Finance is no longer just about numbers and budgets. Today’s finance leaders are stepping up as key strategists, using technology and new ways of working to help businesses grow and adapt in an uncertain world. A recent global study by Deloitte reveals the top trends shaping finance through 2026, showing how artificial intelligence (AI), agility, and fresh skills are transforming the finance function.

The findings come from Deloitte’s inaugural Finance Trends 2026 report, based on a survey in spring 2025 with 1,326 finance leaders in 23 countries. These respondents were mostly Chief Financial Officers (CFOs) or their immediate deputies from companies with annual revenues exceeding US$1 billion, covering all sectors and industries. The survey also included in-depth interviews with nine senior finance executives from global organisations, providing practical insights into how these trends are unfolding.

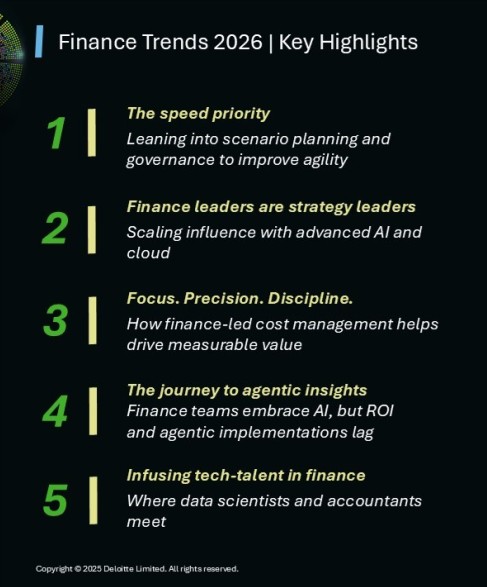

Top 5 trends shaping finance through 2026

The report identifies five key trends that will have the greatest impact on finance leaders and their organisations.

Trend 1 | The speed priority: Advanced scenario planning and agile governance for navigating uncertainty

Finance leaders are using faster, more sophisticated “what-if” planning to navigate uncertainty, balancing cost control with growth investments in a complex world, with supply chain disruptions and economic risks.

Finance chiefs face a tough balancing act: controlling costs while finding smart ways to invest in growth. Supply chain disruptions, economic uncertainty, and changing regulations add to the challenge. Nearly three-quarters of finance leaders say their companies need more resources to seize investment opportunities.

To stay ahead, many are adopting advanced scenario planning, running multiple “what-if” models more frequently to anticipate risks and opportunities. For example, some companies now update forecasts daily instead of monthly, using AI to analyse market trends, customer behaviour, and competitor moves. This helps them make faster, smarter decisions.

Trend 2 | Finance leaders are strategy leaders; especially when they embrace advanced AI and cloud

More than half of finance chiefs now play a central role in shaping company strategy, leveraging AI and cloud technology to optimise costs and improve productivity. They are no longer just number crunchers but proactive business partners. Technology is a key enabler here: those who lead strategy are more likely to use cloud computing and AI to optimise costs and improve productivity.

At Hewlett Packard Enterprise, for instance, the finance team uses AI to automate routine tasks and provide predictive insights, freeing up time to focus on growth and innovation. This shift from traditional finance stewardship to digital leadership is becoming the new norm.

Trend 3 | Focus. Precision. Discipline: How finance-led cost management helps drive measurable value.

Finance leaders who take ownership of cost management tend to deliver better savings with precision and accountability. They combine cloud technology, AI tools, and dedicated expense teams to continuously find efficiencies and drive measurable savings while supporting growth.

Cloud solutions offer flexibility, allowing companies to scale resources up or down without heavy upfront costs. AI helps identify cost-saving opportunities by analysing large volumes of transactions quickly and accurately. Some firms already use AI to spot billing errors early, recovering millions in lost revenue.

Trend 4 | The journey to agentic insights: Finance teams embrace AI, but ROI and agentic implementations often lag

While many finance teams are embracing and experimenting with AI, only a small number have fully embedded AI agents into daily operations, facing hurdles like legacy systems and data privacy concerns. As reported almost two-thirds of finance teams have already deployed AI solutions, but only a small number have fully integrated AI agents into daily operations. Many are still working to prove the return on investment (ROI) and overcome challenges like legacy systems and data privacy concerns.

Data security is especially important in finance, where sensitive information is handled. Companies, like Johnson & Johnson for example, are creating governance models to ensure AI tools are used responsibly and securely.

Trend 5 | Infusing tech-talent in finance: Where data scientists and accountants meet

With talent shortages looming, building the Finance Team of Tomorrow is a challenge. Talent shortages are a major concern. With fewer accounting graduates and many professionals nearing retirement, finance leaders are prioritising technical skills like AI, automation, and data analysis, blending these with traditional finance expertise. As interviewees mentioned, nearly two-thirds plan to add more tech-savvy professionals by 2026.

Training existing staff is also key. Some companies start with simple AI tasks, like generating reports or emails, and gradually build up to more complex uses such as contract analysis. Others are blending finance expertise with data science and engineering to tackle complex challenges.

Looking Ahead

As Clea Evagorou, Partner, Risk, Regulatory & Forensic Leader at Deloitte Cyprus highlights “Our Finance Trends survey offers invaluable insights into the rapidly evolving role of finance leaders and the transformative impact of technology and talent. As companies face increasing uncertainty and complexity, this research provides a clear roadmap for how finance teams can become more agile, strategic, and forward-looking. By embracing advanced scenario planning, leveraging AI and cloud technologies, and investing in the right skills, organisations can not only optimise costs but also unlock new growth opportunities. We encourage businesses to use these findings as a guide to rethink their finance strategies, and act proactively to build future-ready teams, and foster governance models that enable faster, smarter decision-making to be best positioned to thrive in an ever-changing business landscape.”

In short, the future of finance is about being smart, fast, and flexible, powered by technology and led by curious, forward-thinking people. To thrive in the fast-changing business landscape, finance leaders must build connected data systems, adopt a hybrid mindset combining finance and technology skills, and foster agile decision-making. Those who do will not only manage costs better but also drive innovation and growth across their organisations.