Ask WiRE, a company combining real estate know-how with technology has published its Q2 2022 edition of the Ask WiRE Index for property sale and rental values. The Ask WiRE Index covers all districts and main property types, with values from Q4 2009.

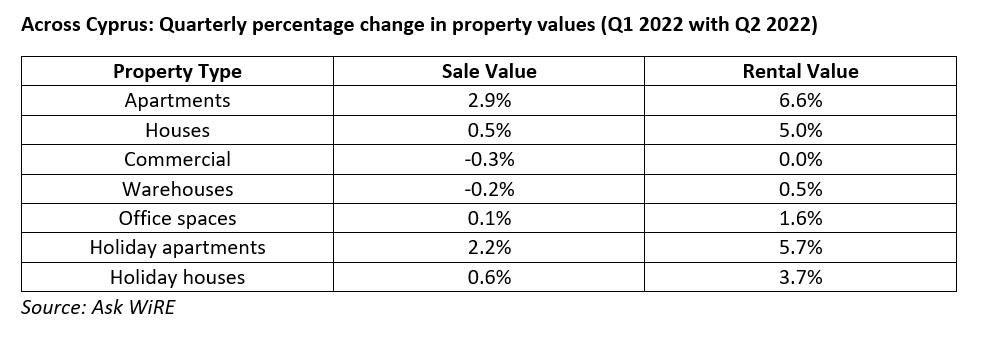

Across Cyprus, on a quarterly basis sale values increased by 2.9% for apartments, 0.5% for houses and 0.1% for offices, and decreased by 0.3% for retail, and 0.2% for warehouses. As for holiday apartments and holiday houses, sale values increased by 2.2% and 0.6%, respectively.

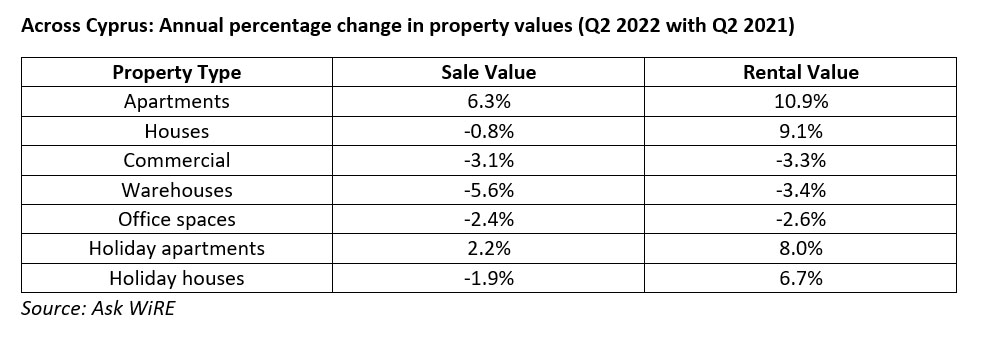

On an annual basis, prices increased by 6.3% for apartments and 2.2% for holiday apartments, while decreased by 0.8% for houses, 3.1% for retail, 5.6% for warehouses, 2.4% for offices, and 1.9% for holiday houses. Larnaca stands out from the districts, as sale values of apartments continued to rise for the fourth quarter in a row (3.1% in Q2 2022).

On a quarterly basis, rental values increased by 6.6% for apartments, 5.0% for houses, 0.5% for warehouses, and 1.6% for offices, and remained stable for retail. As for holiday apartments and holiday houses, rental values increased by 5.7% and 3.7%, respectively. On an annual basis, rental values increased by 10.9% for apartments, 9.1% for houses, 8.0% for holiday apartments and 6.7% for holiday houses, and decreased by 3.3% for retail, 3.4% for warehouses and 2.6% for offices. Famagusta stands out from the districts, as rental values of apartments had a significant increase after a year of stability and an increase of 3.4% in Q4 2021 (increased by 7.9% in Q2 2022).

Pavlos Loizou, CEO of Ask WiRE, commented that “the influx in population due to in-migration over the first half of 2022, the availability of credit for mortgages, and pend-up demand over the past couple of years continues to drive the residential market as investors are looking at ways to generate income. In contrast, the changing landscape around office use and the structure of Cyprus’ banks (less staff, fewer branches), as well as the move to online purchases and the appeal of newly opened shopping malls/ destinations in Nicosia and Larnaca, is having a significant impact on the office and retail market. The headwinds faced by local households are slowing demand for mortgages, while overseas demand is picking up. We are still away from seeing a return to stability, as the landscape around the global economy and geopolitics keeps shifting.”